Mortgage interest rates often dictate how much ‘house’ a borrower can purchase. Many buyers do not realize that minor changes in the interest rate can make a difference of buying that dream home with an office or a sun room or having that office in the basement.

Lets examine how small changes in mortgage interest rates affect a persons home purchasing power. At the original time of writing this article (February 24,2018), Federal interest rate on a 30 Year fixed loan is 4.38% (source). Rates Vary daily, but just a few short months ago on October 19,207, the same mortgage would have cost a borrower 3.88% (source). Exactly .5% less.

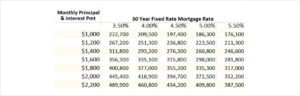

For easy math, lets examine the chart below. Keep in mind, we are looking at only principal and interest payments; typically a monthly payment will include principal & interest, home insurance, property taxes (unless chosen to pay privately) and any HOA fees or maintenance fees. On an FHA or a VA mortgage, we may be looking at additional PMI payments and other fees. These additional obligations will absolutely affect a buyers purchasing power as well. For illustration purposes though, we will omit these from the equation.

The buying power of only 0.5% change in interest rate is incredible. At $1,000 monthly principle & interest (P&I), just a few months ago, someone could have bought almost $13,000 more of “house” then someone buying today. The value gets very steep as we move up in price range. At $2,000 monthly P&I, at that same time, a buyer would have had an extra $26,000 to play with. These are areal numbers, courtesy of Howard Hanna mortgage services.

Where are the interest rates headed? Very hard to say, but we are at high and some speculate we will see a further increase.

What affects mortgage interest rates

Several economic factors affect mortgage interest rates – inflation, economic growth, Federal Reserve Monetary Policy, the bond market and the housing market.

- Inflation. It affects our general buying power, and that does include buying power of a home. Mortgage interest rates take inflation into account and interest rates are higher when inflation is higher. The difference is not large, usually a fraction of a percent, but it is part of the equation.

- Economic Growth. Employment rate as well as indicators like gross domestic product (GDP) are also markers for rising or declining interest rates. When economy is good and people have jobs, there is more demand for mortgages. Demand is high, supply goes down, interest rates go up. Same is true in a declining economy; demand is low, supply goes up, interest rates go down.

- Federal Reserve monetary policy. The Federal Reserve does not set the mortgage rates, but it regulates the money supply upward or downward. An increase in the money supply results in more money to lend or be borrowed, supply is high, so rates are lower. Decrease in the money supply, tightens the available ‘borrowable’ funds and rates go up.

- The bond market. Specifically, mortgage-backed securities. In overly simple terms, banks lump together mortgages into ‘mortgage backed securities’ that can be moved off the bank’s books by being sold as a security to an investor. The yield these securities pay must stay competitive to remain attractive to investors so indirectly, the overall condition of this market indirectly affects mortgage lender rates.

- Housing Market Conditions. The supply and demand come into play again. The stronger the market, the fewer homes are available for sale, less people apply for mortgages, therefore interest rates go down. Same is true for a weaker market, the more homes we have available, the greater the demand (in a good economy); mortgage interest rates go down.

Only time will tell, but for a curious mind, we thought we’d include a 5 year chart.

Jelena Krilova

A pre-eminent real estate agent in Ohio, Jelena Krilova lives by three principles — solution focused attitude, determination and integrity. Grateful for her clients, teammates and colleagues, Jelena has 15 years of experience in helping clients achieve their real estate goals while striving to reinvent the real estate industry with her exemplary work ethics, dedication, and creativity.

Related Posts

January 11, 2021

How to lower & appeal property taxes in Cuyahoga County

One of the most common questions is how…

February 7, 2020

Buy vs Rent case studies over three price ranges. The math behind the recommendation.

We have all heard the recommendations…

January 7, 2020

Cleveland Home Remodeling Trends – Updated 2020

Having been in the real estate business…